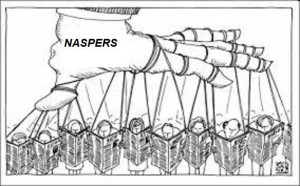

Naspers chief executive, Koos Bekker, R7bn richer

August 3, 2013 Leave a comment

Naspers chief executive Koos Bekker’s remuneration package, which is currently valued at more than R7-billion before tax for the past five years, has broken all previous pay records for JSE executives and is expected to hold the record for the foreseeable future.

The 74 percent surge in the Naspers N share price over the past 12 months, combined with Bekker’s unique remuneration arrangement, has generated several billions of rands of potential profits for Bekker.

At a current price of R795, the 11.7 million shares that Bekker was awarded as remuneration for the five years to the end of March are worth R9.3bn. The cost to Bekker of the shares is just over R2bn.

This puts the value of his remuneration package significantly ahead of any other executive on the JSE, including executives of companies that have their primary listing on an international bourse.

Naspers’s annual report for financial 2013 reveals that 3.9 million shares were released to Bekker on March 31 this year and are being held in reserve for him in the company’s share incentive scheme. “This is the final tranche of his five-year contract entered into on April 1, 2008,” the Naspers remuneration report says.

In terms of his unique remuneration contract Bekker does not receive any salary, bonus, car scheme or medical or pension contributions from the company. Instead, in 2008 he was awarded 11.7 million shares, which vested in three annual tranches of 3.9 million at the end of years three, four and five.

The 11.7 million shares were awarded to Bekker at the ruling price at the beginning of his five-year contract, which was around R150. In addition, the price he has to pay is adjusted for inflation.

The first tranche, which was paid out at the end of financial 2011, cost Bekker R167 a share. The second tranche, at the end of financial 2012, cost Bekker R176 a share. The shares allocated to Bekker in March this year cost him R185 each.

This means that the total cost to Bekker for the 11.7 million shares was just over R2bn, compared with the current market value of those shares of R9.3bn. So, Bekker is currently showing a pretax profit of R7.2bn on his unique five-year remuneration package.

This is Bekker’s third five-year contract with Naspers.

In terms of the first contract, entered into in 1997, Bekker was allocated 3.3 million shares, which were released to him in three tranches ending in December 2003.

The dotcom collapse in 2001 highlighted the high-risk element of the arrangement and there was little value in the Naspers shares by the time they were awarded to Bekker.

In the second five-year contract, Bekker was allocated 4.4 million shares in 2003 at R21.40 a share. The shares were again released to Bekker in three tranches, with the price adjusted for inflation.

The steady upward trajectory of the share price during this five-year period meant that Bekker secured considerable profits.

The third contract, which has just expired, is by far the most valuable in terms of the number of shares awarded as well as the price appreciation.

The single most important factor in the surge in the Naspers share price in recent years is attributed to the performance of, and expectations for, China-based Tencent. Tencent is an acquisition that Bekker, who is regarded as having more guanxi (contacts) in China than most foreigners, championed back in 2004.

In addition to the 11.7 million shares, Bekker holds 4.7 million shares awarded to him in 2002 in terms of the rules of the Naspers share incentive trust. At the current share price, these 16.4 million shares are worth R13bn. The dividend payment on these shares will earn Bekker, and cost Naspers, R63 million a year.

Bekker appears to have sold the 7.7 million Naspers shares he was allocated in terms of the first two five-year contracts.

Supporters of Bekker’s remuneration contract argue that it is an appropriate arrangement given the critical entrepreneurial role he has played in building up the company.

Critics counter that the arrangement is unnecessarily generous and has contributed to the high-risk aspect of the share price.

The annual report does not indicate that Bekker has to hold onto the shares beyond the end of his five-year contract. They point to the fact that Naspers has a higher market capitalisation than Sasol, although its earnings-generating ability is significantly lower.

Remuneration consultants note that the arrangement has essentially de-linked Bekker from the group’s remuneration policies as set out by the remuneration committee. – IOL